With the continuous evolution of the fourth technological revolution, the development of the Internet has also entered a new era of the "Internet +". In this era, many things will be connected to the Internet and become intelligent. Many emerging industries will open up huge markets. IoT technologies such as the Internet of Vehicles, smart logistics, and artificial intelligence have received widespread attention. And indoor positioning is one of them.

Since the concept of Industry 4.0 was came out, the intelligence level of the manufacturing industry has been continuously improved, and the development of the Internet has also entered a new era of "Internet +". Many devices can access the cloud and become intelligent. Emerging industries are booming. IoT technologies such as the Internet of Vehicles, smart logistics, and artificial intelligence have received widespread attention. And indoor positioning is one of them.

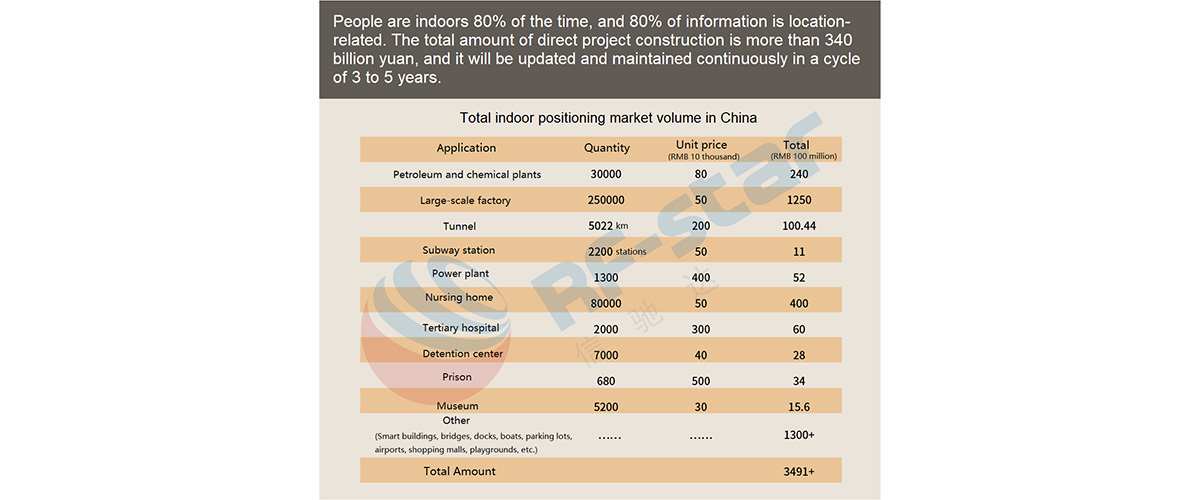

Indoor positioning is a huge market that has gradually been paid attention to in recent years. Because indoor scenes are very important for people's daily production and life, and location data is one of the most basic data dimensions.

According to data provided by Nokia, people spend 87%-90% of their time indoors. The indoor space structure becomes complex, people have higher requirements for real-time and accuracy of the location. For example, it is becoming more and more difficult to find a car in a parking lot, find specific items, and locate relatives who have separated. The demand for indoor positioning has never been higher.

With the outbreak of the epidemic, the spread control of the virus has become the goal of epidemic prevention measures. How to master the closure and mobility of personnel has become the focus. The demand for indoor positioning of personnel has ushered in another climax.

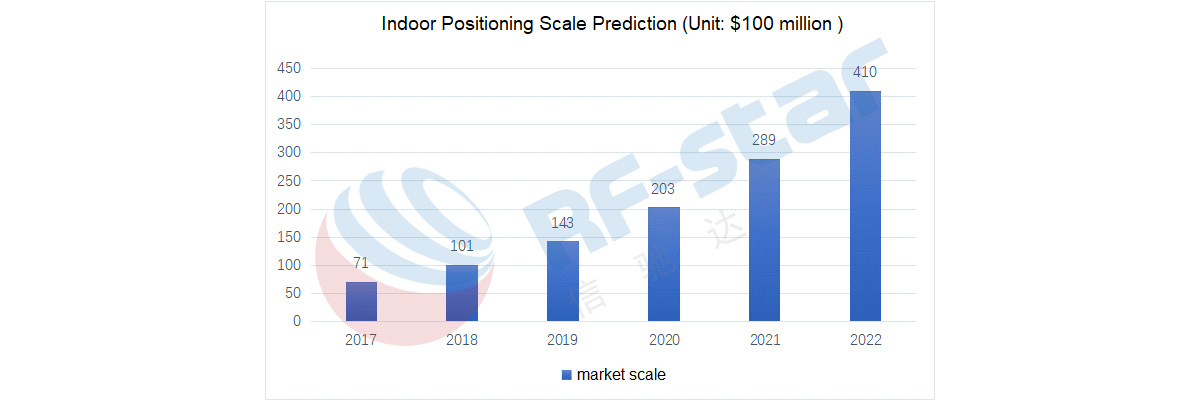

1.The indoor positioning market is growing rapidly

2. Difficulty in market expansion

In the past ten years, the indoor positioning market has continued to be hot, and there are also many heavyweight players such as Apple, Samsung, NXP, etc. As early as seven or eight years ago, Apple set off an upsurge of indoor positioning based on Bluetooth iBeacon technology. However, After the boom, there are not many indoor positioning companies left.

This anomaly is enough for indoor positioning companies to think deeply about the reasons. The indoor positioning market is not lacking in technological innovation, heavyweight players, and capital investment. It can only be analyzed from the indoor positioning application.

On the one hand, although indoor positioning is widely used, there is rarely a separate demand. For the user side, especially the B-side users, they all need a complete set of solutions, which is a complete system solution from indoor positioning device to data collection and uploading to visual operation. And The positioning is only one of the links. The majority of indoor positioning companies can provide more mature indoor positioning terminal products at that time. However, the entire closed-loop positioning system is not mature enough. What terminal customers generally demand is a system-level positioning solution with a short implementation period and little investment in research and development. It has greatly increased the difficulty of developing the indoor positioning market.

On the other hand, the positioning requirements on the application side are not very clear. Although indoor positioning technology can be applied in a wide range of applications and the potential user base is very large. To evaluate whether indoor positioning technology can break out in a certain market, it is necessary to evaluate the role played by indoor positioning technology. Is the role "icing on the cake" or "providing timely help"?

“Providing timely help” means that there is an urgent need for positioning technology in this type of application. A typical application is a high-risk environment including the mandatory management of a chemical plant, or the management of places where the scope of personnel activities is restricted, such as prisons, nursing homes, coal mines, etc. Because of the particularity of the industry itself, it is necessary to manage personnel and assets, and indoor positioning technology can highly match this demand.

There are other non-mandatory management markets. It is necessary to evaluate the input-output ratio to know whether the indoor positioning technology can achieve the desired economic effect goal, such as the logistics cold chain, factory assembly line and other applications.

This type of application cannot be generalized, because different companies have different businesses, different informatization foundations, and even different business models. Therefore, specific projects need to be analyzed in detail.

3. "Internet +" promotes the positioning market to enter a new turning point in 2021

However, in recent years, the development of the indoor positioning technology industry has entered a turning point period. Especially with the continuous advancement of the Industry 4.0 process, the trend of the turning point period is becoming more and more obvious.

Ten years ago, there are few corresponding demands in the market, even if there is centimeter-level positioning technology. Today, with the advent of the Internet of Things and the era of intelligence, companies and individuals are paying more and more attention to data. Business expansion based on data has become the most popular business model. The change of consumer consumption habits is the decisive factor of explosive demand for indoor positioning applications in the scale of commercialization.

From a macro perspective, the commercial market is facing destocking pressure, and commercial development investment is weak. The service industry and consumer market have further expanded, and the development of the Internet has made new retail an outlet for business transformation and upgrading.

From a micro level, residents' incomes continue to increase, and their consumption concepts are also changing. Therefore, when the external environment changes, the transformation and upgrading of consumption concept is the key to the future development of the commercial industry.

With the upgrading of consumption, quality life experience consumption is gradually becoming the core. The change in the pursuit of quality in consumer demand for life has made new requirements for consumer products.

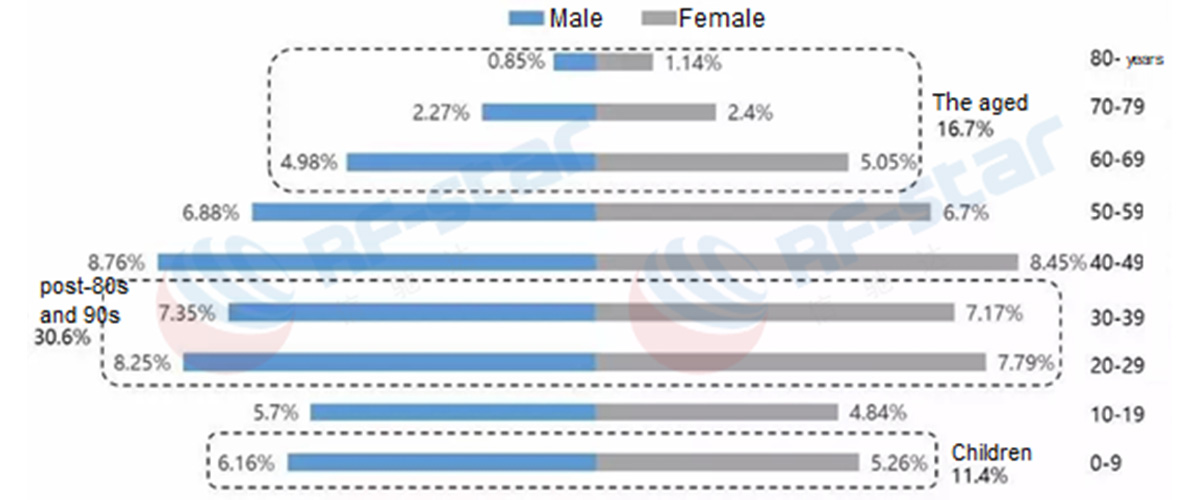

From the perspective of customer group structure, the post-80s and 90s’ pursuit of fashion, trend and individuality have triggered changes in the consumption structure, and they are more willing to pay for experience and services. At the same time, China gradually enters an aging society, and the related medical and elderly care services have gradually become an important consumer format. In addition, with the liberalization of the two-child policy, "entertainment experience consumption", which is dominated by parent-child formats in the business, will soon usher in a development boom.

The maturity of smart IoT technology has gradually reduced the cost of positioning solutions, which can meet the needs of the positioning market. It also allows the indoor positioning industry to develop better.

If indoor positioning technology is to be widely used, technologies such as positioning accuracy, reliability, coverage, and power consumption need to be improved. The indoor positioning technology has been upgraded for multiple generations and can meet the above technical requirements well.

4. The market opportunity for mainstream indoor positioning technology

There are many kinds of indoor positioning technologies on the market, which can respond to different levels of application requirements.

The choice of positioning technology is mainly determined by two aspects:

The second is based on cost, based on meeting application requirements, all users want the lower the price.

The precision of the beacon is generally 2 m ~ 3 m. The beacon terminal device is relatively cheap. Because of low power consumption, it is suitable for large-scale deployment. The Beacon base station calculates the positioning information by collecting the signal strength broadcast by the beacon device. The cost of building a basic positioning system is relatively low, and it has great advantages for applications that require a large number of positioning devices, low cost, low power consumption, and long battery life. In general, the performance of the Bluetooth beacon solution is only satisfactory, and it is a relatively common solution in many meter-level positioning requirements. For example, some applications such as smart warehouses and smart museums can deploy hundreds of Beacon to improve positioning accuracy, and it is easy to maintain.

Another Bluetooth positioning technology AoA/AoD, and the accuracy can reach sub-meter level. Since the SIG released the BLE 5.1 protocol, its high-precision Bluetooth positioning technology has attracted a large number of manufacturers to invest in research. And it can rely on the mobile phone Bluetooth ecology to quickly spread the market. Among all the high-precision positioning technologies, Bluetooth AoA/AoD has obvious advantages in terms of power consumption and price. AoA/AoD requires an antenna array, and the positioning algorithm is more difficult. It needs to invest a lot of research and development strength. And the commercialization of this technology is still in its infancy. With the accumulation of research and development, there are already manufacturers on the market that have developed relevant Demo firmware, which has gradually accelerated the production process of AoA/AoD. It is believed that the Bluetooth AoA / AoD positioning solution will be available.

UWB (Ultra Wide Band) is a wireless carrier communication technology that uses nanosecond non-sinusoidal narrow pulses to transmit data, and the positioning accuracy has reached centimeter level. UWB was mainly used for military radars. The FCC opened UWB technology for civilian use in 2002. Although the positioning technology appeared very early, the popularity of this technology is not high. In the past years, with the market layout of major manufacturers such as Apple, Samsung, NXP, Xiaomi, etc., the technology gradually entered the market. The Apple's Airtags are UWB.

UWB occupies a very wide spectrum. For example, the widely used Decawave UWB chip DW1000 supports the 3 GHz to 7 GHz frequency range, and the data transmission rate can reach hundreds of megabits per second. UWB technology uses pulse signals to send data, and the pulse width is very small, which means that the signal duty cycle is very low. In the positioning system, the distance resolution is positively related to the pulse width. The smaller the pulse width, the smaller the distance resolution, the closer the two points can be distinguished, and the higher the accuracy. It is the narrow pulse and high-frequency band that brings higher distance resolution to UWB positioning technology. In terms of accuracy, it has an advantage that other positioning technologies are difficult to match.

UWB centimeter-level positioning accuracy fully meets the indoor high-precision positioning requirements in indoor positioning. Large bandwidth ensures fast data communication speed, strong anti-multipath ability, strong penetration ability, and low duty cycle.

The promotion of UWB with so many advantages in the positioning market is not very smooth. UWB has a high threshold, and the antenna design is enough to stump many RF manufacturers. UWB product cost is also very high. The establishment of a basic UWB positioning system requires at least 3 positioning base stations and several UWB tags. And the market price is at least thousands of RMB. Compared with Beacon's minimum positioning system which only requires hundreds, the cost of UWB is very high. Moreover, the UWB beam has strong directivity. TDOA or TWR positioning needs to calculate the position of the deployed base station, establish a positioning algorithm system, and obtain positioning information by calculating the time difference between the data received by different base stations. UWB has a high threshold and high cost. It is suitable for applications that require high positioning accuracy, low latency, such as military positioning and monitoring of key security areas.

UWB equipment has a relatively high power consumption. There are still manufacturers on the market that use large-capacity rechargeable batteries or direct power supply. UWB high-frequency band occupancy also means low-frequency band utilization. The cost of UWB is the biggest obstacle. However, with the market layout of major manufacturers, the cost of UWB will inevitably decrease. It also makes UWB the focus of the market, and the mature commercialization of products is just around the corner.

RFID tags are divided into active and passive. Active tags are self-active, the signal processing can be more complicated, and the positioning accuracy will be much higher. It can cover 100 meters under ideal conditions, and the positioning error is about 5 m. It is mainly completed by triangulation, but UWB, ZigBee can also be positioned in this field.

Passive tags are a common RFID. Since the tag itself has no computing power, all signal processing is limited by the reflected signal received by the reader, so the choice of signal processing algorithm will be much smaller. And the reader's recognition range is basically within 10 m, passive tag positioning is generally used for finer positioning.

5. Positioning requirements for multi-technology integration

As China's economic development enters a new era, the retail industry is also changing.

The indoor positioning technology on the market is not limited to the above-listed. In fact, it is difficult for a single positioning technology to meet the application market. Even if it can, it will cause a waste of costs or resources. Therefore, in specific projects, many technical solutions are the integration of multiple types of technologies.

In one application, multiple positioning technologies exist at the same time. For example, in a large shopping mall, Wi-Fi positioning technology can be used for rough positioning requirements. And indoor personnel management can be realized based on Bluetooth Beacon technology. The management of some important assets or areas can be realized based on UWB. And if the data needs to be collected and uploaded, it also needs to be combined with other wireless technologies.

하나의 애플리케이션에서 여러 포지셔닝 기술이 조합되어 사용됩니다. 예를 들어 물류 팔레트 관리에서 Bluetooth 태그를 사용하여 상품을 찾을 수 있습니다. 데이터 수집 및 업로드 측면에서 물류 창고 영역은 일반적으로 매우 큽니다. 기존 WiFi 게이트웨이를 사용하여 데이터를 수집하는 경우에도 배선 비용이 많이 듭니다.

BLE + LoRa 솔루션은 두 가지 장점을 잘 결합할 수 있습니다. 저비용 및 저전력 소비로 인해 Bluetooth 태그는 대량 배치에 편리합니다. LoRa 게이트웨이가 데이터를 수집한 후 장거리 전송 기능은 데이터를 로컬 서버 또는 클라우드로 전송할 수 있습니다. LoRa 게이트웨이의 비용은 상대적으로 높지만 각 창고는 수요를 충족하기 위해 몇 개의 게이트웨이만 필요하며 전체 비용과 실제 통신 효과는 매우 좋습니다.

따라서 미래 포지셔닝 기술 응용 시장에서 다중 기술 통합 솔루션은 시장 요구에 더 부합합니다.